Good experiences with FNBO so far, The .025-.027 value of the points is a good return especially if you add in the Amtrak points rebate at the time of purchase and the coupons on your AGR account. The only issue these days is that Amtrak LD sleeper trips are getting quite expensive and require loads of points to book.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Help Support Amtrak Unlimited Discussion Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

gregg_vw

Train Attendant

Interesting. I nearly always overpay on my Chase cards (IHG, Sapphire, Southwest etc.) and it's never been a problem or flagged in any way. FNBO's more cautious procedures may not be the norm in this industry.

It depends on the age of your account and what your credit limit is. Transactions that add up to more than your credit limit in one month is considered suspicious, especially if it's a new account. That's even if the current balance never goes over the limit.

People who get a card with a spend bonus frequently get bitten by this, especially if there's a low limit. They get a $2000 limit and try to push through $5000 in in one month.

People who get a card with a spend bonus frequently get bitten by this, especially if there's a low limit. They get a $2000 limit and try to push through $5000 in in one month.

This is the correct answer. It's called credit cycling and definitely raises red flags. If you have a longer or in-depth relationship with the bank, then credit cycling probably won't affect you.It depends on the age of your account and what your credit limit is. Transactions that add up to more than your credit limit in one month is considered suspicious, especially if it's a new account. That's even if the current balance never goes over the limit.

People who get a card with a spend bonus frequently get bitten by this, especially if there's a low limit. They get a $2000 limit and try to push through $5000 in in one month.

diesteldorf

Lead Service Attendant

- Joined

- Mar 27, 2006

- Messages

- 395

Not sure if this is targeted, but I just got the following promo from Amtrak and FBNO. I have the $99 Amtrak card.

"Between August 9, 2024 and October 31, 2024 enjoy earning 3X bonus points1 on streaming services when you pay with your Amtrak Guest Rewards® Mastercard®."

"Between August 9, 2024 and October 31, 2024 enjoy earning 3X bonus points1 on streaming services when you pay with your Amtrak Guest Rewards® Mastercard®."

I got that, but I'm already getting a good cashback on streaming on another card.Not sure if this is targeted, but I just got the following promo from Amtrak and FBNO. I have the $99 Amtrak card.

"Between August 9, 2024 and October 31, 2024 enjoy earning 3X bonus points1 on streaming services when you pay with your Amtrak Guest Rewards® Mastercard®."

I think they're hoping that you'll switch your streaming payments to them for the 2-month bonus, and then not bother to switch them back.

$10.37

IA, Iowa Old Vintage Antique Collectables For Sale Illinois Central Railroad Bridge Missouri River 1940

Vintage Postcards - Towns in 50 USA States

$235.99

Pennsylvania Railroad William Atterbury Signed Auto Mounted Cut Index Card D13 - College Cut Signatures

Sports Memorabilia

$10.37

IA, Iowa Old Vintage Antique Collectables For Sale Newton and Northwestern Railroad Bridge Unused

Vintage Postcards - Towns in 50 USA States

$4.00

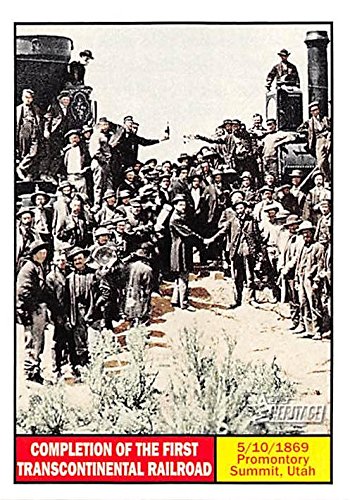

Completion of the First Transcontinental Railroad trading card (Promontory Summit Utah, 5/10/1869) 2009 Topps Heritage #113

Autograph Warehouse (AW Authentic)

$10.37

IA, Iowa Old Vintage Antique Collectables For Sale Illinois Central Railroad Bridge Missouri River Unused

Vintage Postcards - Towns in 50 USA States

$20.99

$27.98

Walthers Trainline HO Scale Model Flatcar with Logging Crane - Alaska Railroad 17104, Blue

Amazon.com

diesteldorf

Lead Service Attendant

- Joined

- Mar 27, 2006

- Messages

- 395

You're definitely right about them hoping you forget to switch.....and I know some US Bank cards give a bonus if you charge 11 consecutive months of streaming. Of course, if there is any interruption the bonus is forfeited.

If you already have the Chase Sapphire Preferred that offers 3X on streaming by default.

If you already have the Chase Sapphire Preferred that offers 3X on streaming by default.

We signed up for a couple of streaming services when they had heavily-discounted rates (like $0.99-$1.99/month) during Christmas/New Year's. If we were to switch to using our AGR Mastercard for those services, perhaps we'd lose the discounted rate?Not sure if this is targeted, but I just got the following promo from Amtrak and FBNO. I have the $99 Amtrak card.

"Between August 9, 2024 and October 31, 2024 enjoy earning 3X bonus points1 on streaming services when you pay with your Amtrak Guest Rewards® Mastercard®."

diesteldorf

Lead Service Attendant

- Joined

- Mar 27, 2006

- Messages

- 395

I would just leave your current setup alone. It's not worth the possible headaches since the monthly charges are so small anyway.

I was told recently by FNBO that I would have to reapply for the no fee card. Since I do not travel as much as I used to travel, I decided to cancel the premium card. I was told to wait a few days before applying for the no-fee card. I waited over a week and applied today. I unfroze my credit temporarily and I was approved within minutes with a credit limit slightly higher than my credit limit on my premium card.Has anyone had any luck downgrading from the $99 card to the no-fee card? I was told previously by an FBNO rep that they won't do this and each card must be applied for separately.

I learned another lesson with FNBO the hard way earlier this year. I had the premium card already and wanted to get the 40k point bonus promotion.I was told recently by FNBO that I would have to reapply for the no fee card. Since I do not travel as much as I used to travel, I decided to cancel the premium card. I was told to wait a few days before applying for the no-fee card. I waited over a week and applied today. I unfroze my credit temporarily and I was approved within minutes with a credit limit slightly higher than my credit limit on my premium card.

I flew too close to the sun, thinking I could be clever and cancel that card and reapply a couple of weeks later. I was rejected because I already had the base card.

I pulled this gambit successfully with BofA a few years ago, but FNBO has a different approach.

diesteldorf

Lead Service Attendant

- Joined

- Mar 27, 2006

- Messages

- 395

Did you already have the basic and premium card prior to the migration from BOA to FBNO, or did you acquire one or both directly from FBNO?I learned another lesson with FNBO the hard way earlier this year. I had the premium card already and wanted to get the 40k point bonus promotion.

I flew too close to the sun, thinking I could be clever and cancel that card and reapply a couple of weeks later. I was rejected because I already had the base card.

I pulled this gambit successfully with BofA a few years ago, but FNBO has a different approach.

Just curious. It'll be interesting if you ever really "want" the premium card. Will they tell you to cancel your basic card, with the potential of NOT being approved for the premium and NOT having any AGR card.

Part of me is curious, because, while I'm currently happy with the premium card and will keep it, applying for the no-fee card would allow me to maintain my relationship with FBNO if I ever cancel my premium Amtrak and premium Best Western cards.

I already had both the premium and basic card with BofA which converted to FNBO. For other reasons, I am not going to risk cancelling my current card to try again for the premium, for fear that for some technicality I'll be aced out.Did you already have the basic and premium card prior to the migration from BOA to FBNO, or did you acquire one or both directly from FBNO?

Just curious. It'll be interesting if you ever really "want" the premium card. Will they tell you to cancel your basic card, with the potential of NOT being approved for the premium and NOT having any AGR card.

Part of me is curious, because, while I'm currently happy with the premium card and will keep it, applying for the no-fee card would allow me to maintain my relationship with FBNO if I ever cancel my premium Amtrak and premium Best Western cards.

Just a comment: I have never experienced customer service, at least in the financial services industry, as efficient as FNBO.

Almost anytime I call, morning, late afternoon, whenever, invariably someone comes on before the recording "Your estimated wait time is ..." completes.

With BOA, it could be a half hour or more. Plus, their people are pleasant to deal with and generally very quick to act on issues.

At least, this is my experience. YMMV.

Almost anytime I call, morning, late afternoon, whenever, invariably someone comes on before the recording "Your estimated wait time is ..." completes.

With BOA, it could be a half hour or more. Plus, their people are pleasant to deal with and generally very quick to act on issues.

At least, this is my experience. YMMV.

Second all that. Their Customer Service all seem to make a genuine effort to help in finding solutions and are "Midwest Nice" in the bargain. BoA agents all seemed just stuck on their scripts. I have the strong feeling that FNBO empowers their agents more than BoA.Just a comment: I have never experienced customer service, at least in the financial services industry, as efficient as FNBO.

Almost anytime I call, morning, late afternoon, whenever, invariably someone comes on before the recording "Your estimated wait time is ..." completes.

With BOA, it could be a half hour or more. Plus, their people are pleasant to deal with and generally very quick to act on issues.

At least, this is my experience. YMMV.

I just received an Unsolicited "Upgrade" from the Regular AGR MC to the "World Card" with an Increase in the Credit Limit .

No mention of an Annual Fee, so I'm wondering if this is happening to everyone with FNBO AGR Cards since so many Banks are cutting back on the Number of Cards they offer???

As for Customer Service, I've never had such helpful and friendly service from CS Agents in my over 60 years of dealing with Credit Card Companies including Chase,BOA, American Express,Diners Club ( remember them?)etc etc.

No mention of an Annual Fee, so I'm wondering if this is happening to everyone with FNBO AGR Cards since so many Banks are cutting back on the Number of Cards they offer???

As for Customer Service, I've never had such helpful and friendly service from CS Agents in my over 60 years of dealing with Credit Card Companies including Chase,BOA, American Express,Diners Club ( remember them?)etc etc.

"World Card" is a Master Card designation; it has no impact on AGR benefits.I just received an Unsolicited "Upgrade" from the Regular AGR MC to the "World Card" with an Increase in the Credit Limit .

No mention of an Annual Fee, so I'm wondering if this is happening to everyone with FNBO AGR Cards since so many Banks are cutting back on the Number of Cards they offer???

As for Customer Service, I've never had such helpful and friendly service from CS Agents in my over 60 years of dealing with Credit Card Companies including Chase,BOA, American Express,Diners Club ( remember them?)etc etc.

World Card allegedly has more benefits than a standard Master Card, but if you look at the Guide to Benefits on the FNBO website, there's nothing there to write home about.

I don't "track" these things, but there may be those here who do. Does anyone have a sense of a pattern when AGR might next do a 30,000 or higher promo for the premier card?

AFS1970

Service Attendant

- Joined

- Jan 3, 2016

- Messages

- 179

About six months ago I got a new AGR car in the mail, I didn't ask for it and it had the same number and expiration date as the old one. I called FNBO and they said I had been upgraded by Mastercard, but that my wife would not get a new card until the expiration date in 2028. I am not sure what the new benefits are, but it really isn't making much of a difference to me. Last month I had a questionable charge on my card, the immediately called me, froze the card, issued both of us new ones so now my wife also has whatever this enhanced card is. All around good customer service.

Even better, it's now 35K.I don't "track" these things, but there may be those here who do. Does anyone have a sense of a pattern when AGR might next do a 30,000 or higher promo for the premier card?

https://frequentmiler.com/amtrak-preferred-card-35k-welcome-offer/

fhussain44

Train Attendant

- Joined

- Jan 28, 2013

- Messages

- 89

I got this card in early 2023 and cancelled it early 2024 . Can I get the bonus again if I apply for the 35k one now? Or do I need to wait at least 2 years from when I first got the card?

Yes, easy. They only require a minimum of 24 hours after cancelling, but suggest waiting two days. I just did this this week. I cancelled my base card to upgrade to the premier card. FNBO does not allow one to two two of similarly branded cards at one time.I got this card in early 2023 and cancelled it early 2024 . Can I get the bonus again if I apply for the 35k one now? Or do I need to wait at least 2 years from when I first got the card?

Just be aware that the new card will slightly ding your credit rating for about six months. Not a big deal.

I'm not concerned about that. My credit is strong enough and I am unlikely to need new credit for some time.Just be aware that the new card will slightly ding your credit rating for about six months. Not a big deal.

fhussain44

Train Attendant

- Joined

- Jan 28, 2013

- Messages

- 89

Got two weird denials from FNBO. First was for a family member who had the card two years ago and cancelled a year ago. Initially it was instantly approved. Then strangely got a letter a week later saying it was denied because there were “elements associated with fraud”? Googling that with fnbo did not bring up much except one person who said it was due to an outdated web browser. I think they had used an older browser running on Windows 8.1 for that application. So perhaps that triggered it.Yes, easy. They only require a minimum of 24 hours after cancelling, but suggest waiting two days. I just did this this week. I cancelled my base card to upgrade to the premier card. FNBO does not allow one to two two of similarly branded cards at one time.

Then another family member applied who also had the card two years ago and it said “pending”. Then got an email a few hours later saying it was denied and will get a letter explaining why in the mail. Will post what that says later.

Latest posts

-

Acela 21 (Avelia Liberty) development, testing and deployment (2025)

- Latest: JuniusLivonius

-

-

-

-

-

Bi-level Long Distance (LD) fleet replacement RFP discussion H2 2024 - 2025

- Latest: Green Maned Lion

-