...and same for me. I paid on line and it was posted the next day.Got my first points posting from FNBO to my AGR account today.

Same with my wife.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AGR Credit Card change (October 2022)

- Thread starter neroden

- Start date

Help Support Amtrak Unlimited Discussion Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

- Status

- Not open for further replies.

Just received my Preferred card today, which I had applied for on the public offer after cancelling my BofA card last month. I called FNBO, and the very nice rep confirmed that I am eligible for the bonus points with $1,000 purchases. I immediately paid my cable bill and about 3 months of my insurance bill to get to exactly $1,000, so I'll be watching to see when the bonus points show up.

I found a link on the "classic" website to download the Benefits Guide. It was a bare bones MC World version, with no meaningful benefits: no warranty extension, no rental car insurance, no nuthin'. I'm wondering whether this card really does have no retail benefits, or they've just not gotten around to linking to the correct Benefits Guide. Some of my no-fee cards have been reducing or eliminating benefits over the past couple of years, but I expected more from a $99/year fee card.

I found a link on the "classic" website to download the Benefits Guide. It was a bare bones MC World version, with no meaningful benefits: no warranty extension, no rental car insurance, no nuthin'. I'm wondering whether this card really does have no retail benefits, or they've just not gotten around to linking to the correct Benefits Guide. Some of my no-fee cards have been reducing or eliminating benefits over the past couple of years, but I expected more from a $99/year fee card.

I received points today. I double checked and it was spot on. had several dining charges and confirmed double points.. I'm happy.

I just filed for (and got approved for) the new AGR card de novo. We'll see how this goes. (The 30k welcome bonus was something that I logically could not pass on...) I'll see where I am when I get there, but I'll probably dump a tax payment on there to grab a batch of TQPs if I'm gonna "need" them this year.

My husband and I have each used our new (no-fee) AGR MasterCard once earlier in the week (him 3 days ago, me yesterday), and the transactions are appearing in our FNBO account online, but no AGR points from those transactions yet. What's the typical delay between use of an AGR credit card and receiving the AGR points for those transactions?

My husband and I have each used our new (no-fee) AGR MasterCard once earlier in the week (him 3 days ago, me yesterday), and the transactions are appearing in our FNBO account online, but no AGR points from those transactions yet. What's the typical delay between use of an AGR credit card and receiving the AGR points for those transactions?

Typically around when the statement period ends.

The last month of Bank of America’s involvement was a bit unique in that they were being done as the transactions posted. Otherwise, pretty much every points-benefit credit card I’ve ever used will give you those points after the statement closes.

$20.99

$27.98

Walthers Trainline HO Scale Model Flatcar with Logging Crane - Alaska Railroad 17104, Blue

Amazon.com

$21.75

Scenes Along The Oversea Railroad - Key West Extension Florida - 1919 Curt Teich Souvenir Postcard Folder #1039

grinvideoproductions

$4.00

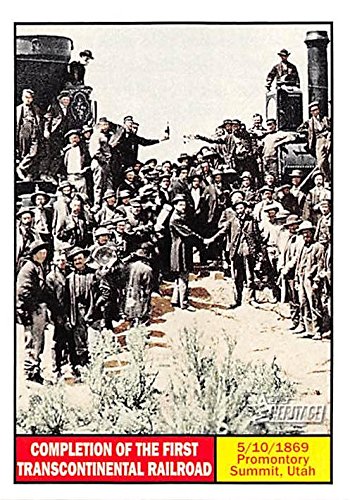

Completion of the First Transcontinental Railroad trading card (Promontory Summit Utah, 5/10/1869) 2009 Topps Heritage #113

Autograph Warehouse (AW Authentic)

As Trogdor stated, they are, generally, posted the day or day after your statement is "cut".My husband and I have each used our new (no-fee) AGR MasterCard once earlier in the week (him 3 days ago, me yesterday), and the transactions are appearing in our FNBO account online, but no AGR points from those transactions yet. What's the typical delay between use of an AGR credit card and receiving the AGR points for those transactions?

The problem with charging tax payments around here is that there's about a $45 "convenience fee" added.I just filed for (and got approved for) the new AGR card de novo. We'll see how this goes. (The 30k welcome bonus was something that I logically could not pass on...) I'll see where I am when I get there, but I'll probably dump a tax payment on there to grab a batch of TQPs if I'm gonna "need" them this year.

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

Yeah. I will have to pay my annual tax bill several times before I would be able to collect any TQPsThe problem with charging tax payments around here is that there's about a $45 "convenience fee" added.Anyhow, my property tax isn't anywhere near $5,000.

Between our property tax bill and the quarterly estimated tax payments the hubby makes (because he's self-employed), those would probably be enough to collect TQPs, IF we were to charge them on the AGR credit card -- but we've always cut paper checks instead.Yeah. I will have to pay my annual tax bill several times before I would be able to collect any TQPs

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

I usually pay my property tax using E-check rather than credit card, since I try to avoid paying the service charge that goes with credit card payments which is not insignificant.Between our property tax bill and the quarterly estimated tax payments the hubby makes (because he's self-employed), those would probably be enough to collect TQPs, IF we were to charge them on the AGR credit card -- but we've always cut paper checks instead.

One reason why we do paper checks for the property tax payments is because they can be dropped off at any local bank, which saves a stamp, and saves the gas money which would otherwise be spent on a road trip to the county seat.I usually pay my property tax using E-check rather than credit card, since I try to avoid paying the service charge that goes with credit card payments which is not insignificant.

On the other hand, the IL Secretary of State encourages drivers to do license plate renewals online. They'll accept either e-checks or credit cards; we go the credit card route (so we could in theory use our AGR credit card for that), but there is an approx. $3.00 "convenience fee" tacked onto the approx. $150 credit card payment for each license plate renewal (and we have 4 of those each year, counting our daughter's car, which is a hand-me-down from her dad, so the title is still in his name).

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

MODERATOR'S NOTE: Sigh. Another case where I have to admonish myself before reminding others that this thread's subject is AGR credit card change, and we should stick to it in this thread.

Thanks for your your understanding, cooperation and participation.

Thanks for your your understanding, cooperation and participation.

I've done the math - the points usually just about wash with the fees, but if I park it on a card with added spend-induced benefits (e.g. Delta giving MQMs at spend thresholds), it adjusts the calculus.The problem with charging tax payments around here is that there's about a $45 "convenience fee" added.Anyhow, my property tax isn't anywhere near $5,000.

My statement on one of my cards closed yesterday. Points showed up in my AGR account this morning.

My other card statement closes on the 21st. So we will see then. But so far so good.

My other card statement closes on the 21st. So we will see then. But so far so good.

BOA was posting my points daily as charges cleared in October before the transition, they weren't waiting for the statement date. My statement just cycled last week and I am happy to say FNBO posted my points, apparently correctly, for activity done with them after transition. BOA had already posted what they owed me before the cutover.Talked to 2nd agent at FNBO. They also do not have an answer. After looking at my statement, it looks like they are only transferring points for purchases made since they took over from BOA. Now the question is how to get the points for the purchases made between Oct 7 and Oct 23 when FNBO took over the account. I will be paying FNBO for all those purchases on this statement but no points sent to AGR for the pre FNBO period. ? They are having another person call me back within 48 hours. We will see how that goes.

This was my experience as well. FNBO posted the points on time. I thought it looked a bit short at first, but then realized BOA had been posting points on a daily basis before the transition. The posting of points by FNBO was the last wait-and-see-what-happens item in the BOA-FNBO transfer. All seems to be well, and for me, it looks like it was a seamless and trouble-free transfer.BOA was posting my points daily as charges cleared in October before the transition, they weren't waiting for the statement date. My statement just cycled last week and I am happy to say FNBO posted my points, apparently correctly, for activity done with them after transition. BOA had already posted what they owed me before the cutover.

Henry Kisor

Service Attendant

- Joined

- Sep 14, 2007

- Messages

- 199

FNBO posted my points as soon as the statement closed. Non-event.

I got my first statement in a kind of weird way. Apparently it's not available on the website (desktop only, no mobile  ). A link was sent to my email to download the statement. Personally I don't like that.

). A link was sent to my email to download the statement. Personally I don't like that.

Anyway, the statement informed me that future purchases of Amtrak food&bev receive a 10% credit on the bill. I never buy f&b from Amtrak but I may consider it now. It was nice getting the double points for dining!

Anyway, the statement informed me that future purchases of Amtrak food&bev receive a 10% credit on the bill. I never buy f&b from Amtrak but I may consider it now. It was nice getting the double points for dining!

- Joined

- Feb 18, 2003

- Messages

- 8,526

I got my first statement in a kind of weird way. Apparently it's not available on the website (desktop only, no mobile). A link was sent to my email to download the statement. Personally I don't like that.

Anyway, the statement informed me that future purchases of Amtrak food&bev receive a 10% credit on the bill. I never buy f&b from Amtrak but I may consider it now. It was nice getting the double points for dining!

It is available on the website. Homepage, left menu listing, "View Statements". Brings up the list of available statements for download.

Besides the 10% (or 20% for the preferred card) statement credit for onboard purchases, you also earn 3 points per dollar for Amtrak purchases (including food and beverage).I got my first statement in a kind of weird way. Apparently it's not available on the website (desktop only, no mobile). A link was sent to my email to download the statement. Personally I don't like that.

Anyway, the statement informed me that future purchases of Amtrak food&bev receive a 10% credit on the bill. I never buy f&b from Amtrak but I may consider it now. It was nice getting the double points for dining!

Last edited:

Maverickstation

Lead Service Attendant

Received the new card in the mail from FNBO, activated it, no issue so far.

Then I went to set up my "on-line" account and kept getting error messages.

Turns out our new bank for the Amtrak card does for have the ability to support those of us

who use Safari on our Macs. I use 2 older MACS, and I have had no issues with any companies that

I do business with.

All FNBO told is is that they are "working on it", and that the holders of the Amtrak cards are the first time that they have had so many MAC users.

Where did Amtrak find this bank ??

Ken

Then I went to set up my "on-line" account and kept getting error messages.

Turns out our new bank for the Amtrak card does for have the ability to support those of us

who use Safari on our Macs. I use 2 older MACS, and I have had no issues with any companies that

I do business with.

All FNBO told is is that they are "working on it", and that the holders of the Amtrak cards are the first time that they have had so many MAC users.

Where did Amtrak find this bank ??

Ken

I use an "old" Macbook Air and have not issues. Ok, I use Google Chrome, not Safari, so that's probably why.Received the new card in the mail from FNBO, activated it, no issue so far.

Then I went to set up my "on-line" account and kept getting error messages.

Turns out our new bank for the Amtrak card does for have the ability to support those of us

who use Safari on our Macs. I use 2 older MACS, and I have had no issues with any companies that

I do business with.

All FNBO told is is that they are "working on it", and that the holders of the Amtrak cards are the first time that they have had so many MAC users.

Where did Amtrak find this bank ??

Ken

Maverickstation

Lead Service Attendant

I use an "old" Macbook Air and have not issues. Ok, I use Google Chrome, not Safari, so that's probably why.

Exactly, the older Mac Book, and Mac mini that I use can not be upgraded to Chrome, and thus use Safari, which again no other company has issues with.

Ken

Exactly, the older Mac Book, and Mac mini that I use can not be upgraded to Chrome, and thus use Safari, which again no other company has issues with.

Ken

Winecliff Station

Service Attendant

That explains why I can access the site on my iPhone 13 mini but not my 2015 MacBookI use an "old" Macbook Air and have not issues. Ok, I use Google Chrome, not Safari, so that's probably why.

- Status

- Not open for further replies.

Latest posts

-

-

New North Brunswick NJT station on the NEC

- Latest: Touchdowntom9

-

-

-

-

-

-