Most of the people who complained about PINS use them already any way, since they are required for ATM transactions and in a number of other scenarios. It's pretty amusing.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pin cards not accepted...

- Thread starter caravanman

- Start date

Help Support Amtrak Unlimited Discussion Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

Greater security and speed and convenience are often opposites. If I used a biometric, I would have much greater security, but at a higher cost, and users would not be able to hand their cards to someone else to buy things with or get money without prior arrangements. Stand in line at a supermarket and watch how many people have another family member shop and use the "benefits card", or at the ATM people get money with someones card who gave them the PIN. Wouldn't bother me, but the howling would be something.

seat38a

Engineer

Go to this site (Barclays UK) and look at the card picture. It has the Visa logo on it. That is what they mean.Just a supplementary question... The Amtrak site quoted above says that any debit cards used must have the "credit card logo" on them, again, I don't know what that means?

No worries anyway, it was simply a surprise, that what I thought was a security feature, the pin, was not accepted in person at the Amtrak ticket counter.

Ed.

https://www.barclays.co.uk/current-accounts/debit-cards/

Triley

Real Lead Service Attendant

As someone who has worked the Cascades, lives in Canada, and is familiar with both the US and traditional chip and pin systems....the info that others have been trying to give is correct. If the card has a major credit card logo (Visa, MasterCard, Maestro, Discover, or American Express) the card will work, but will be swiped, and you will be asked for a signature.Now you've gotten me curious. Next time I take the Cascades to Portland and buy my ticket at the station, I'll first try to pay with my Natwest chip and pin card, just to see what happens. If it fails, well, I'll have a fallback of my US chip and signature card.

I can't speak for the stations, but onboard our credit card machines have the chip reader disabled. I'm not 100% sure, but I believe it has to do with needing a data connection to authorize the card when using the chip, which is something we can't guarantee on any train.

Triley

Real Lead Service Attendant

Not to be pedantic, but it's either chip and signature, or chip and pin. Not or.What the US currently has is Chip *OR* Signature, which is utterly meaningless, by design. The abnormally high card related theft rates seen in the US are used as an excuse to charge higher domestic transaction fees than the rest of the industrialized world. If US card theft decreased it would undermine the narrative for excessive transaction fees, and in the view of our banks and processing services having higher theft with higher fees is the overall better option for them.

Yeah, the financial institutions who take up to 7% of our annual earnings in the form of middleman transaction fees.

I do remember being happy about hearing the States were finally moving to chip technology, then I found out we were getting this crap... Although I get less confused looks from cashiers in Canada, now that I at least have a pin, they still get thrown off guard when I need to sign the slip.

The idea of the chip is to enable authorization to occur before the transaction is completed Without a data connection that cannot occur. On a swipe type transaction you can store the info and "batch send" it later. Nobody would accept that as a regular routine for large purchases,a store would call for authorization on the phone, but for small purchases the rewards outweigh the risk.

$4.00

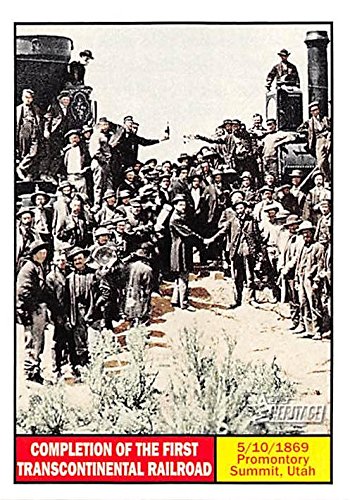

Completion of the First Transcontinental Railroad trading card (Promontory Summit Utah, 5/10/1869) 2009 Topps Heritage #113

Autograph Warehouse (AW Authentic)

$12.54

$14.75

TSA Approved Cable Luggage Locks, Re-settable Combination with Alloy Body, Black 2 Locks.

Forge Life LLC

$20.99

$27.98

Walthers Trainline HO Scale Model Flatcar with Logging Crane - Alaska Railroad 17104, Blue

Amazon.com

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

Actually, the chip protocol does have a profile that allows storing the information and processing it offline later if connection is not available. The threshold value if transaction upto which such is allowed can be administratively set up for the POS.

I’m curious: Who, exactly, were the people that complained about PINs? Since the vast majority of Americans have never had a chip-and-PIN credit card (heck, I’d wager that the large majority have never even seen such in operation since most folks don’t even travel beyond this country’s borders), what would they have been complaining about? Note that I’m not counting debit cards (which have used PINs since forever) since I gather most folks don’t use the PIN in the context of a purchase (i.e. when at the store they still used it like a credit card).Most of the people who complained about PINS use them already any way, since they are required for ATM transactions and in a number of other scenarios. It's pretty amusing.

Of course, this is the country that still produces the penny even though many people literally throw them away, so I guess doing logical stuff with respect to money just isn’t in our culture.

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

I actually do see a lot of people carefully enter their PIN during purchases, presumably using their Debit Card.

Worse than the penny, look at the dollar coin vs the dollar bill. Much of the opposition was likely spurred on by processors and merchants who oppose anything that might cost them money, or processing time (which is monetized)

Same here.I actually do see a lot of people carefully enter their PIN during purchases, presumably using their Debit Card.

caravanman

Engineer

I have a credit limit on my credit card, so I assume that I can't "borrow" any more than that credit on the card?

With the debit card, I assume that if the funds are not in my debit card bank account, the transaction will fail?

So I am confused as to how I can use the debit card as a credit card? How much can I "borrow" on it if I don't have money in my account to cover my purchase? At what point does my debit card become a credit card, according to this system?

Ed.

With the debit card, I assume that if the funds are not in my debit card bank account, the transaction will fail?

So I am confused as to how I can use the debit card as a credit card? How much can I "borrow" on it if I don't have money in my account to cover my purchase? At what point does my debit card become a credit card, according to this system?

Ed.

Last edited by a moderator:

Not sure about Europe, but the option for overdraft coverage on a debit exists, in a similar manner to overdraft coverage of a checking account. In the US, the law requires that you opt in to this feature, fees are high....with a credit card you can pay your monthly statement balance and avoid fees and interest, a debit card o/d automatically triggers a hefty fee, if you have the feature. If not, your transaction is rejected....

Devil's Advocate

⠀⠀⠀

Well, at least we've made credit card theft as speedy and hassle free as possible.Greater security and speed and convenience are often opposites.

If I can use either method independently of each other, as is the case here in the US, then logically it is an "OR" condition. What the bank or credit processor happens to call it in their marketing and instruction materials is a different matter entirely.Not to be pedantic, but it's either chip and signature, or chip and pin. Not or.

They can be as careful as they like but all a thief has to do is snatch the card and then find a retailer that will accept the numbers by phone or a swipe of the strip instead of the chip. Easy pickings.I actually do see a lot of people carefully enter their PIN during purchases, presumably using their Debit Card.

Last edited by a moderator:

Triley

Real Lead Service Attendant

It's more in the way that the transaction is processed. If you come to the States and use your debit card and I run it as a credit card (the only way I would be able to run it), the funds will only come from your checking account, unless you have specified to your bank otherwise. If you have ever used your credit card in an Amtrak cafe, that's exactly what has happened.I have a credit limit on my credit card, so I assume that I can't "borrow" any more than that credit on the card?

With the debit card, I assume that if the funds are not in my debit card bank account, the transaction will fail?

So I am confused as to how I can use the debit card as a credit card? How much can I "borrow" on it if I don't have money in my account to cover my purchase? At what point does my debit card become a credit card, according to this system?

Ed.

For the US debit cards.... If I run my card as debit, I will likely be asked for my pin number, and the retailer receives the money from checking account immediately. If I run it as credit, I will likely be asked for a signature (or nothing at all), and the retailer receives my funds (from my checking account) after a few days.

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

Oh of course. I don’t disagree at all on the ease of theft. I was merely contesting the apparent claim of someone that people do not key in their PINs that often and use their debit cards as credit cards whenever possible.They can be as careful as they like but all a thief has to do is snatch the card and then find a retailer that will accept the numbers by phone or a swipe of the strip instead of the chip. Easy pickings.

caravanman

Engineer

Why am I not surprised that in the US the business is protected, allowed to sell to a person without the funds, rather than the "debit card system" protecting the poor from getting into debt.In the US, the law requires that you opt in to this feature, fees are high

Ed.

VTTrain

Lead Service Attendant

- Joined

- Dec 3, 2018

- Messages

- 324

You are misunderstanding the concept. Overdraft protection is an opt-in service that only the consumer gets to choose. Giving consumers choices is hardly a bad thing.Why am I not surprised that in the US the business is protected, allowed to sell to a person without the funds, rather than the "debit card system" protecting the poor from getting into debt.

It took a great deal of outcry to get the law changed to require opt in rather than opt out. That is relatively recent. The fees on overdrafts are pretty high. Giving a consumer a chance to do something that is not in their best interests may well be a bad thing. It is not always a good thing.

seat38a

Engineer

You CAN'T. Just because we are talking about "Credit Card Logo" (Visa, Mastercard etc.) does not make your "Debit Card" a "Credit Card" or the other way around. It just means if the merchant can accept your card for payment or not. So when you see this sign: https://www.mysecuritysign.com/american-express-discover-mastercard-visa-logo-decal/sku-lb-2219I have a credit limit on my credit card, so I assume that I can't "borrow" any more than that credit on the card?

With the debit card, I assume that if the funds are not in my debit card bank account, the transaction will fail?

So I am confused as to how I can use the debit card as a credit card? How much can I "borrow" on it if I don't have money in my account to cover my purchase? At what point does my debit card become a credit card, according to this system?

Ed.

It means the merchant can accept your card if it has one of those logos on it regardless of what type of card it is. The system does not care if your card is a debit card, credit card or a gift card. It will go through.

VTTrain

Lead Service Attendant

- Joined

- Dec 3, 2018

- Messages

- 324

The consumer is in the best position to know what is in their interests.It took a great deal of outcry to get the law changed to require opt in rather than opt out. That is relatively recent. The fees on overdrafts are pretty high. Giving a consumer a chance to do something that is not in their best interests may well be a bad thing. It is not always a good thing.

No, the consumer is very often deliberately misled and under informed. Many of them do not know what is best.

VTTrain

Lead Service Attendant

- Joined

- Dec 3, 2018

- Messages

- 324

Then your issue is with regulating information given to consumers so that it is truthful and readily available. With proper information, the consumer is always in the best position to know what is in their best interests - unless they are incompetent, which would allow their guardian to know what is bestNo, the consumer is very often deliberately misled and under informed. Many of them do not know what is best.

jis

Permanent Way Inspector

Staff member

Administator

Moderator

AU Supporting Member

Gathering Team Member

Many consumers who even that they are competent unfortunately are not so in practice either. There is an assumption of an ideal consumer in play here.

Latest posts

-

-

-

-

-

-

Superliner trains' removal and restoration of cars 2024

- Latest: F900ElCapitan

-

-

-